Selling a property often means paying off your mortgage early, but did you know you could be subject to an Early Repayment Charge (ERC)? This is an important consideration if you’re selling during a fixed-term mortgage period.

What Is an Early Repayment Charge?

An ERC is a fee charged by your mortgage lender if you repay your mortgage before the agreed term ends, especially if you’re on a fixed-rate mortgage. The charge compensates the lender for the interest they lose from your early payment.

How Much Can the Charge Be?

The ERC amount varies depending on:

- The mortgage lender

- How long is left on your fixed term

- The size of the outstanding mortgage balance

Typical ERCs can range from 1% to 5% of the outstanding mortgage, so it’s important to check with your lender early in the sale process.

How to Avoid or Minimise ERCs:

- Wait Until Your Fixed Term Ends: If you’re close to the end of your fixed-rate period, consider waiting to avoid the charge.

- Port Your Mortgage: Some lenders allow you to transfer (or “port”) your existing mortgage to your new property, avoiding ERC.

Understanding ERCs before selling your property can help you make informed financial decisions and avoid unexpected costs.

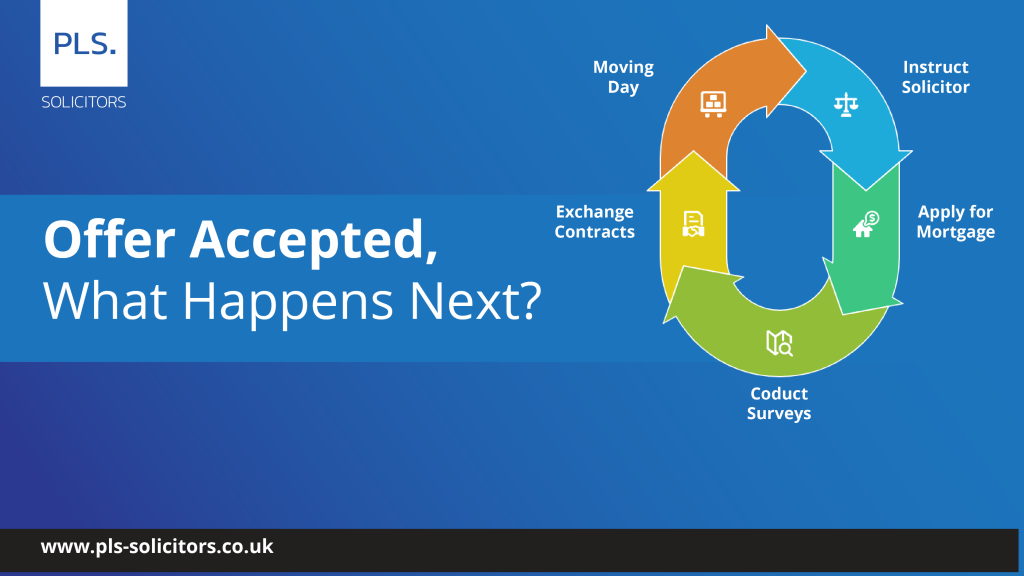

Why Choose Us for Your Property Sale?

At PLS we are a modern, technology-driven law firm, making the conveyancing process as smooth and efficient as possible.

Prefer a personal touch?

There’s always someone available at the other end of the phone to answer your questions. Plus, even if your conveyancer is away, our flexible team is fully informed and ready to assist with your case at any time.

Get in touch with us today to experience seamless service and expert legal advice for your property sale!